Wealthramp Back Story

Would You Hire Yourself As Your Financial Advisor?

November 28, 2016

My new collaboration with “Sixty and Me”

September 20, 2017 I wasn’t even old enough to rent a car, but in my early 20’s I was recruited to be a stock broker. And I was pretty excited about it. It felt like I was on my way to something big. Once I passed all the requisite exams, then went through a couple of months of OTJ training, I was stunned and a little sickened. I learned really quickly that I’d just committed to becoming a telemarketer. It wasn’t the career I’d envisioned, and it wasn’t a role that over time I’d come to appreciate. This big, respected Wall Street brand name brokerage firm expected me to smile and dial until I built up a respectable book of business— meaning getting enough suckers to buy whatever investments I was pushing. Did I actually know more about investing and risk management than 99% of the general public? Maybe. I probably knew a little something about a few things but not enough to make my living posing as an expert.

So instead of making those 100 cold calls a day, I tried really hard to do nothing. And I figured eventually they’d find me and I’d get fired. Only somehow instead of getting out, I got deeper into the business by getting a promotion. In my new role, I was supposed to ‘manage' other brokers (aka advisors) of all ages and experience levels. My main responsibility was to keep encouraging the sales culture at the same time fending off complaints that came daily from the general investing public, including from adult children whose elderly parents were sold annuities they needed about as much as they needed a tattoo and a skateboard. As a Vice President, (now I was 27), making good money and hating every minute.

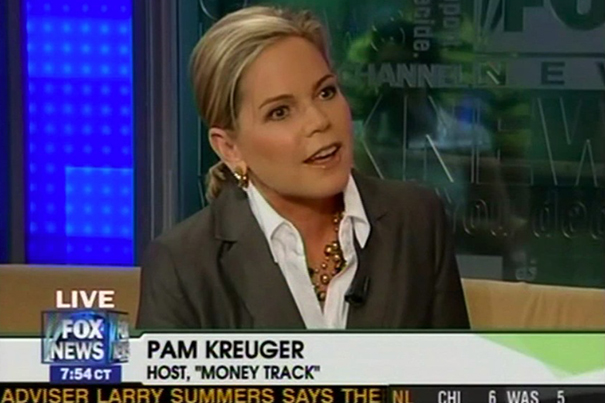

Within a couple of years, I left the commission world of the business entirely to join a different kind of investment firm that was building a platform to support independent registered investment advisors (RIA). These are the real financial advisors. They don’t have big advertising budgets, you won’t find them at big traditional brokerage firms, and they don’t sell insurance. They don’t make money from commission kickbacks at all. Independent registered investment advisors work directly for their clients who pay them to do one thing: provide objective guidance and financial advice. A few years went by and I got out of the financial services biz completely and started doing some TV. I created my Public Television show, MoneyTrack in 2005 and it ran on 255 PBS stations as a weekly series. The whole reason I dreamed up this new show was because I wanted to use television to educate everyday investors about the very things I’d seen and could pass on. The premise of MoneyTrack is to demonstrate that anyone can understand the basics of saving, investing and managing money. All on their own. Kids as young as 14 can learn how to invest. Ben Stein, John Bogle, Jeremy Siegel, Burton Malkiel— even Warren Buffett were some of my favorite guests for our segment called, “Investing 101” on every MoneyTrack episode.

During our third season of the show, I wrote the companion book to MoneyTrack and I made dozens of national appearances on CNN, Fox & Friends, CBS Morning Show, and many other talk shows across the country. Our team was getting emails from viewers from everywhere. Many asking us questions about how to find good financial advisors. My co-host Jack Gallagher and I were out on speaking engagements and we kept hearing one particular question over and over. I had to stop and just... listen. The question was so simple. Here’s what our audiences were saying: “We don’t want to invest all on our own… we need some guidance. But how do we find really good advisors who aren’t selling something?” That question became the problem I had to solve.

Wealthramp is my answer. Knowing not every independent advisor is good, just as not all brokers are bad, I start by rejecting 85% of all financial advisors. I invite those who are qualified and not commission-driven. These advisors make their living from fees, and they have to be willing to put that in writing, and demonstrate they practice as true fiduciary advisors. By eliminating the sales people and zooming into expertise, I’m empowering consumers by encouraging full transparency. We use an ‘eHarmony’ approach to connect individuals to advisors by simply listening to what our audiences tell us are their biggest financial priorities. Then we match those priorities to those fiduciary advisors who fit. I’m just delivering what our audiences say they want.

Really good advisors are out there. They’re just not easy to find, and that’s where I come in. I invite you to look at Wealthramp and grow with me as I thoughtfully roll out this brand new service across the country. And understand my mission is to help America realize that anyone at any age or income level can access high quality financial planning — you don’t have to be wealthy.

So instead of making those 100 cold calls a day, I tried really hard to do nothing. And I figured eventually they’d find me and I’d get fired. Only somehow instead of getting out, I got deeper into the business by getting a promotion. In my new role, I was supposed to ‘manage' other brokers (aka advisors) of all ages and experience levels. My main responsibility was to keep encouraging the sales culture at the same time fending off complaints that came daily from the general investing public, including from adult children whose elderly parents were sold annuities they needed about as much as they needed a tattoo and a skateboard. As a Vice President, (now I was 27), making good money and hating every minute.

Within a couple of years, I left the commission world of the business entirely to join a different kind of investment firm that was building a platform to support independent registered investment advisors (RIA). These are the real financial advisors. They don’t have big advertising budgets, you won’t find them at big traditional brokerage firms, and they don’t sell insurance. They don’t make money from commission kickbacks at all. Independent registered investment advisors work directly for their clients who pay them to do one thing: provide objective guidance and financial advice. A few years went by and I got out of the financial services biz completely and started doing some TV. I created my Public Television show, MoneyTrack in 2005 and it ran on 255 PBS stations as a weekly series. The whole reason I dreamed up this new show was because I wanted to use television to educate everyday investors about the very things I’d seen and could pass on. The premise of MoneyTrack is to demonstrate that anyone can understand the basics of saving, investing and managing money. All on their own. Kids as young as 14 can learn how to invest. Ben Stein, John Bogle, Jeremy Siegel, Burton Malkiel— even Warren Buffett were some of my favorite guests for our segment called, “Investing 101” on every MoneyTrack episode.

During our third season of the show, I wrote the companion book to MoneyTrack and I made dozens of national appearances on CNN, Fox & Friends, CBS Morning Show, and many other talk shows across the country. Our team was getting emails from viewers from everywhere. Many asking us questions about how to find good financial advisors. My co-host Jack Gallagher and I were out on speaking engagements and we kept hearing one particular question over and over. I had to stop and just... listen. The question was so simple. Here’s what our audiences were saying: “We don’t want to invest all on our own… we need some guidance. But how do we find really good advisors who aren’t selling something?” That question became the problem I had to solve.

Wealthramp is my answer. Knowing not every independent advisor is good, just as not all brokers are bad, I start by rejecting 85% of all financial advisors. I invite those who are qualified and not commission-driven. These advisors make their living from fees, and they have to be willing to put that in writing, and demonstrate they practice as true fiduciary advisors. By eliminating the sales people and zooming into expertise, I’m empowering consumers by encouraging full transparency. We use an ‘eHarmony’ approach to connect individuals to advisors by simply listening to what our audiences tell us are their biggest financial priorities. Then we match those priorities to those fiduciary advisors who fit. I’m just delivering what our audiences say they want.

Really good advisors are out there. They’re just not easy to find, and that’s where I come in. I invite you to look at Wealthramp and grow with me as I thoughtfully roll out this brand new service across the country. And understand my mission is to help America realize that anyone at any age or income level can access high quality financial planning — you don’t have to be wealthy.

If you're interested in learning more about how to find the right fiduciary advisor, I invite you to reach out and set up a personal phone consultation with me.

I’m here to help.

I’m here to help.

2 Comments

This is really interesting. What an amazing journey!

Keep up the amazing work, Pam!